The Future of the Global Economy: One Step (ahem, Year) Ahead

Posted: April 6, 2015 Filed under: Economy, ETFs, Finance, Hedge Funds | Tags: alternative investments, economy, ETFs, hedge fund cloning, hedge funds, investments, return replication, smart beta Comments Off on The Future of the Global Economy: One Step (ahem, Year) AheadWho can tell the future?

Most people are not that good at predicting the future of the economy and the stock market, but there are quite a few pretty talented people who are. Most importantly, they are willing to bet their money (and a whole lot of it) on their vision of the future, instead of just yapping about it on television with no real consequences to themselves (think Ben Stein or Jim Cramer). These people are hedge fund managers, especially those who follow directional global economy based strategies.

Hedge funds are run by smart guys. They strive to generate attractive risk-and-return patterns for their investors through a wide variety of investment strategies. Broadly speaking, these strategies could be classified as “search for alpha” (e.g. “equity market neutral”) and “bets on beta” (e.g. “global macro”). Alpha strategies aim at generating returns patterns that are not related to the market or any known economic risk factors. Beta active strategies, on the other hand, generate returns by taking positions driven by underlying economic factors. The best beta active hedge fund managers are pretty good as a group in anticipating which of the economic factors would deliver superior performance in the future. If we could only see these positions, we would’ve been able to peek into the future (as perceived by a group of really smart hedge fund managers)…

Yes, we can!

Jun Duanmu, Yongjia Li, and I have developed a methodology of first identifying hedge fund managers who are skilled in their “beta activity”, and then only considering “cloneable” hedge funds, whose returns are almost entirely explained by exposures to economic risk factors. These managers are not on a hunt for alpha, they are all about beta, and they are pretty good in predicting what the future holds for the global economy. Most important, we can successfully clone these hedge fund returns with portfolios of readily available ETFs! Our smart beta ETF clone portfolios reveal exposures to economic risk factors that beta active hedge fund managers are betting on.

In the rear view mirror

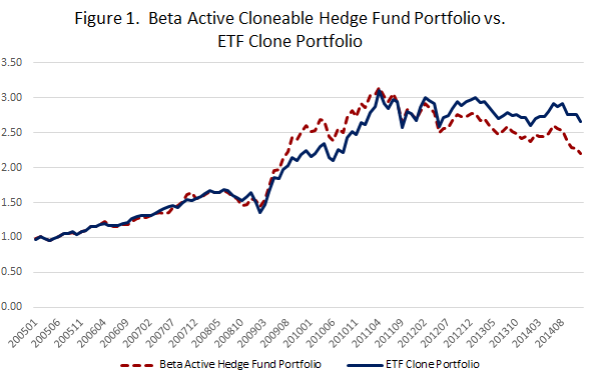

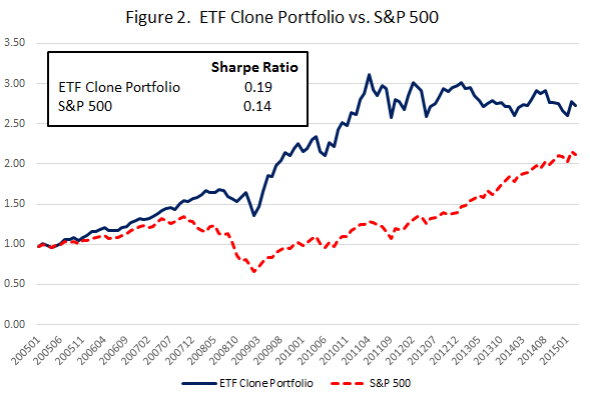

Our methodology of cloning anticipatory bets of the best beta active hedge fund managers works remarkably well in replicating (and even outperforming) hedge fund returns (see figure 1). Furthermore, our smart beta ETF clone portfolios deliver great long-term performance, especially compared to the S&P 500 index (see figure 2). Our ETF portfolios avoided massive losses in 2008, while delivering more stable returns with very good long-term Sharpe ratios.

One step (ahem, year) ahead

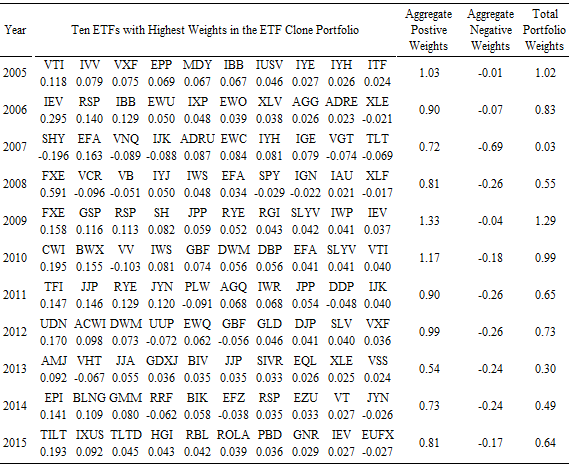

Our methodology relies on annual rebalancing, essentially assuming that the bets taken by the best beta active hedge funds would play out in one year. That is not a given, as it impossible to precisely time broad macroeconomic factors… However, it is insightful to consider what those positions historically were, and what they are now. The table below presents the top ten factor weights along with the cumulative total, long, and short exposures in ETF clone portfolios across 2005 – 2015 (as of January 1 of each year).

Following top beta active hedge fund managers resulted in considerably lower cumulative risk exposures in our ETF portfolios prior to the market meltdown of 2008, and prevented steep losses during that time. This is consistent with stories of numerous hedge fund managers (e.g. John Paulson, Michael Burry) who were spot on in predicting the market meltdown of 2008. On the other hand, 2013 was a year marked by pessimism among beta active hedge fund managers, as overall risk exposures of ETF clone portfolios were the lowest since the 2007-2008. Perhaps, it was the lack of confidence in the US Congress to work out a sensible solution to the upcoming fiscal cliff and the inevitable debt ceiling crisis. However, things eventually got sorted out, and even the partial US Government shutdown in 2013 didn’t result in much stock market drag, while the hedge fund portfolio and their ETF clone suffered losses. While it seems like the hedge fund managers saw the mess coming, their bearishness didn’t play out then…

What about now?

It is interesting to consider the largest 2015 bets of the top beta active hedge fund managers (provided in the table above) as a crystal ball, predicting the future of the world economy. While the overall positions are not as bearish as they were in 2007-2008 or 2013, they don’t look overly bullish either. The most salient features of the 2015 portfolio include well-diversified international exposures, pronounced tilts toward size and value risk factors, long positions in the international renewable energy and natural resources sectors, and a few targeted bets on foreign economies. However, the top ten exposures don’t provide the picture of the heaviest international bet, which is the long exposure to the Russian economy, captured by the combined weight of RBL and RUSL. RUSL provides daily 3x long exposure to Market Vectors Russia index, and its weight of 0.026 falls just outside the top ten exposures. Hence the combined long exposure to the Russian economy from RBL and RUSL stands at 0.120, being the second-heaviest exposure behind TILT.

Bottom line

Overall, while the top beta active hedge fund managers are not bearish on the US or European economies, it seems like their current targeted bets lie elsewhere…

Disclaimer: I do not personally benefit from any improvement in the Russian economy, except for a warm-and-fuzzy feeling for my former motherland.