The Battle for the Last Mile, or the Future of Retail Investing

Posted: June 23, 2014 Filed under: ETFs, Finance | Tags: ETFs, future, investment advisors, investments, last mile Comments Off on The Battle for the Last Mile, or the Future of Retail InvestingQuite a few years ago, back in 2008, I had the following conversation with one of my MBA students, Billy Ruck:

Billy: Why aren’t ETFs more popular now? They are great…

Alexey: Yes, ETFs are great! It’s a conspiracy, man!

As outlandish as my response may have seemed, it was absolutely true. Since this interaction, it’s been fascinating to see how both parts, the ETFs and the conspiracy, have been playing out. But, before we break out the tin foil hats, let me expand a bit on my 2008 answer…

ETFs are great!

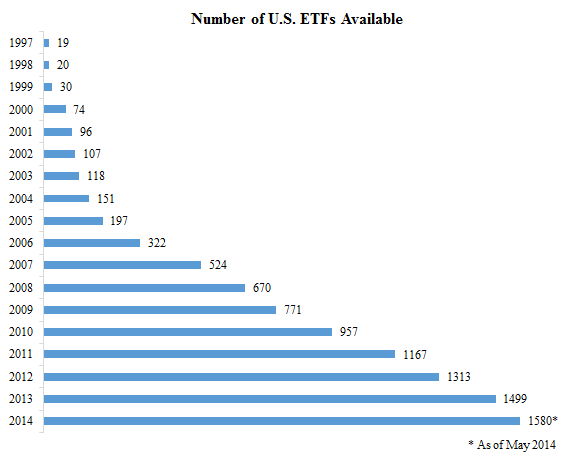

In fact, ETFs are not just great – they are awesome!!! They offer liquid and transparent investment options for a great variety of investment strategies. They range from vanilla S&P 500 index trackers (say, SPY) to pretty exotic strategies such as writing covered call options (PBP) or writing put options on high volatility stocks (HVPW). It is even possible to replicate many hedge fund returns with portfolios of existing ETFs! No wonder the number of ETFs and available strategies is growing at breakneck pace (see chart below)!

Most important, ETFs do all of the above at a very low cost, with a typical expense ratio being way below 1%. For example, on the low end, the expense ratio for SPY is 0.09%, while PBP and HVPW represent the “high” end of expense ratios with 0.75% and 0.95%, respectively. This is much better than 1% to 2% management fees for actively managed equity mutual funds (who, by the way, underperform the S&P 500 on average), or 2-and-20 fees charged by hedge funds who may follow strategies not too different from PBP or HVPW.

These low expense ratios are made possible by the low cost structures employed by ETFs. For example, by automating the trading process the fund removes the need to hire an overpaid fund manager. Furthermore, investors can get in and out of an ETF by simply buying and selling publicly listed shares, hence there is no need to pay distribution costs or kickbacks to brokers/dealers/financial advisors. And that could be a problem…

It’s a conspiracy, man!

As ETFs don’t typically pay distribution costs, there is no direct financial incentive for brokers/dealers/financial advisors to suggest them to retail investors who may not be aware of their options with ETFs. Worse yet, many defined contribution retirement plan members are forced into a relationship with investment companies who specifically exclude ETFs from their offerings. Tellingly, Fidelity’s own employees sued the company claiming substandard investment choices in their 401(k) retirement plans. Talk about conspiracy against ETFs!

Unfortunately, the retail investment industry is currently dominated by a few large established companies and a cottage industry of financial advisors who got accustomed to high fees and kickbacks by peddling many inferior investment products and pretending that conflicts of interest don’t exist. It doesn’t help that many investors need years of paying excessive fees while getting subpar performance to see how bad some of these investment products are.

The battle for the last mile

In a way, the current state of the investment industry reminds me of broadband internet adoption in the late 1990s. It was the time when major telecom companies were trying to outdo each other by building high capacity fiber optic trunk lines, while neglecting the development of “the last mile”, i.e. the low capacity wires that actually connect to customer homes. This wonderful high capacity infrastructure stayed underutilized for years, until the last mile was built (and Netflix came along). In the end, the broadband battle was won not by building superfast trunk lines, but by a slow and painful process of building connections to individual customers.

In the investment management industry today, ETFs are akin to these high capacity fiber optic cables of the late 1990s – they have wonderful potential and great capacity, but the actual adoption is not where it could be. The last mile connection to individual investors is still being controlled by the old vested interests, allowing them to charge fat fees on unsuspecting investors.

In order to give individual investors access to great low cost investment opportunities, like ETFs, it is necessary to build an alternative connection to each and every investor wallet (or smartphone), bypassing traditional ways of distribution for investment products. This is not easy, and could be just as painful as laying physical wire to customers’ homes… That is, unless it is done by a company that already has a relationship with a majority of potential investors, has earned its customers’ trust with stellar conduct and products, and hasn’t tried squeezing every penny out of them. There are not too many companies that fit this bill – Google, Apple, Microsoft, Amazon, Facebook, and Netflix come to mind. But, could these “non-finance” firms fill this need? Sure. Of these, Google, Microsoft, and Amazon would be my prime suspects, as these companies have demonstrated their ability in working with corporate clients. For example, as these companies already manage corporate email, storage, and logistics systems, managing corporate 401(k) might not be far behind…

Just imagine for a second a company like Google providing you with a service of managing your retirement savings in a transparent way and at a truly low cost. Bundle this with unbiased personalized advice and very helpful information displayed when and where you need it… All from your smartphone. Would that not be a breath of fresh air? Wouldn’t it squeeze currently established financial intermediaries? You bet! This vision is not too different from the future of investments envisioned in recent reports by PwC and KPMG.

We already have a great investment infrastructure with ETFs that provides transparent high quality investment options at low cost. The only question is, who will win the battle for the last mile to bring its benefits to customers? And, how?

I don’t know exactly how the future of the investment industry will look, but I have a feeling that the battle for the last mile has already begun…