Smart Beta ETF Portfolios: Cloning Beta Active Hedge Funds

Posted: December 10, 2014 Filed under: ETFs, Finance, Hedge Funds | Tags: ETFs, hedge fund cloning, hedge funds, investments, return replication, smart beta Comments Off on Smart Beta ETF Portfolios: Cloning Beta Active Hedge FundsCloning hedge fund returns is a tricky business. Some hedge fund strategies, like S.A.C. Capital Advisors’ trading in Elan and Wyeth shares off insider tips, cannot be replicated by any algorithmic cloning procedure. On the other hand, returns for many hedge funds appear to be driven by exposures to latent risk factors not readily discernible to average investors. As John H. Cochrane of the University of Chicago observes:

As I look across the hedge fund universe, 90% of what I see is not “picking assets to exploit information not reflected in prices,” it is “taking exposure to factors that managers understand and can trade better than clients.”

The above sentiment on hedge funds is largely shared by Cliff Asness of AQR, who claims that

…more often than not, they charge too much for these straightforward, non-magic strategies and package them, again, with too much net long exposure.

If hedge fund returns are indeed driven by alternative risk factor exposures, then it should be possible to approximate the returns of these funds by taking positions in securities whose returns proxy for the underlying risk factors. We call such funds “cloneable”, and develop a methodology that successfully replicates their returns at a lower cost with portfolios of ETFs (see my earlier post and research paper with Jun Duanmu and Yongjia Li).

Unfortunately, our methodology of replicating “cloneable” hedge funds doesn’t provide an answer on whether “cloneable” hedge funds are a good investment overall. For example, being successful in cloning hedge funds that invest in underperforming risk factors would be of little consolation to an investor. The much more exciting goal would be to clone only such hedge funds that are also good in beta active management, i.e. in taking positions in risk factors that deliver superior returns in the future. Identifying such funds that are good in beta active management is exactly the objective of my other research paper with Jun Duanmu and William R. McCumber.

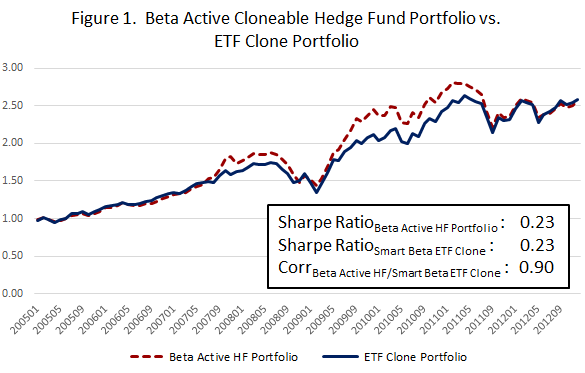

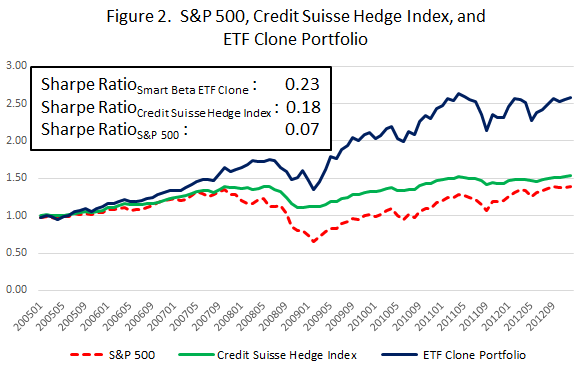

Combining the methodologies of the two papers, i.e. only cloning good beta active hedge funds that are suitable for cloning, and rebalancing the clone portfolio once a year, yields the portfolio of ETFs with truly outstanding performance (documented in detail in this research paper). Figure 1 provides the comparison of the portfolio of the best beta active “cloneable” hedge funds with its ETF clone portfolio, and figure 2 provides the comparison of the ETF clone portfolio with the Credit Suisse hedge fund index and the S&P 500 index from 2005 to 2012.

Why is the ETF clone portfolio so successful? It is likely due to the relatively long-term nature of beta active management, when managers take positions driven by a broad range of macroeconomic factors. As it is impossible to precisely time macroeconomic factors, managers may not profit from their positions for some time until macroeconomic conditions play out (for example, Michael Burry’s bets against subprime mortgage backed securities taken in 2005 were not profitable for two years until 2007). This allows the ETF clone portfolio to replicate beta exposures of the best beta active hedge funds, successfully identifying risk factors that would deliver superior performance in the future.

Why is the ETF clone portfolio so successful? It is likely due to the relatively long-term nature of beta active management, when managers take positions driven by a broad range of macroeconomic factors. As it is impossible to precisely time macroeconomic factors, managers may not profit from their positions for some time until macroeconomic conditions play out (for example, Michael Burry’s bets against subprime mortgage backed securities taken in 2005 were not profitable for two years until 2007). This allows the ETF clone portfolio to replicate beta exposures of the best beta active hedge funds, successfully identifying risk factors that would deliver superior performance in the future.

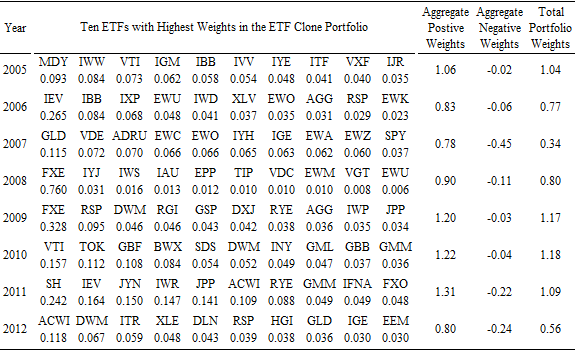

The table below presents the top ten factor weights along with the cumulative total, long, and short exposures in the ETF clone portfolio across 2005 – 2012. The results are very intuitive, as we see top beta active hedge funds scaling down their aggregate risk exposure as early as 2006, and moving into pronounced defensive positions in 2007 marked by long exposure to gold (GLD), cumulative short exposure of -0.45, and the all-time low total aggregate exposure of 0.34. Interestingly, the top holding in January 2011 was a Short S&P500 ETF (SH), and the S&P 500 index did decline in 2011. This shows a great deal of foresight on behalf of top beta active hedge fund managers.

Finally, the ETF clone portfolio is implemented through a “smart beta” strategy, as it is constructed with liquid investment instruments, with annual rebalancing by a transparent algorithmic approach. Judging by its outstanding performance, we can even say that it produces a very smart beta!

Finally, the ETF clone portfolio is implemented through a “smart beta” strategy, as it is constructed with liquid investment instruments, with annual rebalancing by a transparent algorithmic approach. Judging by its outstanding performance, we can even say that it produces a very smart beta!